iowa inheritance tax form

Get everything done in minutes. Adopted and Filed Rules.

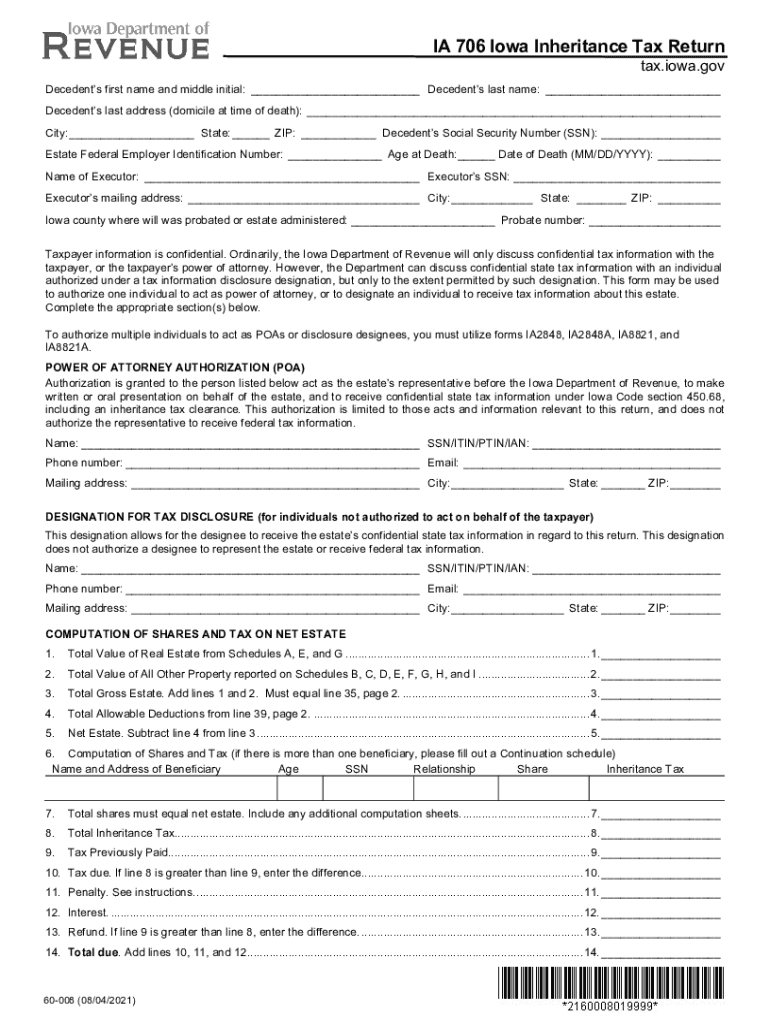

2021 Form Ia Dor 706 Fill Online Printable Fillable Blank Pdffiller

Its important to file the Iowa Inheritance Tax form Form IA 706 by the last day of the 9th month after the person passed away.

. File a W-2 or 1099. The document has moved here. This is something you need to take into consideration before preparing Iowa Last Will and Testament to avoid any legal fees and penalties from the IRS in the future.

Iowa has no estate tax but does have an inheritance tax. Iowa inheritance tax is a tax paid to the State of Iowa and is based upon a persons. Fill out securely sign print or email your 706 iowa inheritance estate tax return 2013 form instantly with signNow.

Report Fraud. The most secure digital platform to get legally binding electronically. The personal representative is required to designate on the return who is to receive the clearance.

If the return fails to. Assets bequest to corporations or socialfraternal organizations dont fit the qualifications as educational religious or charitable and are therefore not exempt. Iowa Estate Tax Versus Iowa Inheritance Tax.

To pay inheritance and estate tax in the state of Iowa file a form IA 706. What is Iowa inheritance tax. Inheritance Tax Rates Schedule.

Does Iowa Have an Inheritance Tax or an Estate Tax. The inheritance tax return must be filed and any tax due must be paid on or before the last day of the ninth month after the death of the decedent or life tenant. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor.

Report Fraud. An extension of time to file the. Iowa InheritanceEstate Tax Return IA 706 Step 1.

An estate tax is levied against the entirety of an estate including any property monetary assets business assets etc owned by the decedent. This document is found on the website of the government of Iowa. This is something you need to take into consideration before preparing Iowa Last Will and Testament to avoid any legal fees and penalties from the IRS in the future.

Iowa Inheritance Tax Form 2020-2022. Learn About Sales. If the deceased persons net estate discussed below is worth 25000 or less no inheritance tax is due.

Learn About Property Tax. Adopted and Filed Rules. It must also be paid within that time otherwise.

Inheritance tax clearance will be issued by the Department. Up to 25 cash back Exemptions From Iowa Inheritance Tax. See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611.

If you are a parent grandparent great-grandparent child.

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Atr Eliminate Iowa S Death Tax Iowans For Tax Relief

/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

Free Iowa Small Estate Affidavit Form Affidavit For Distribution Of Property Pdf Eforms

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

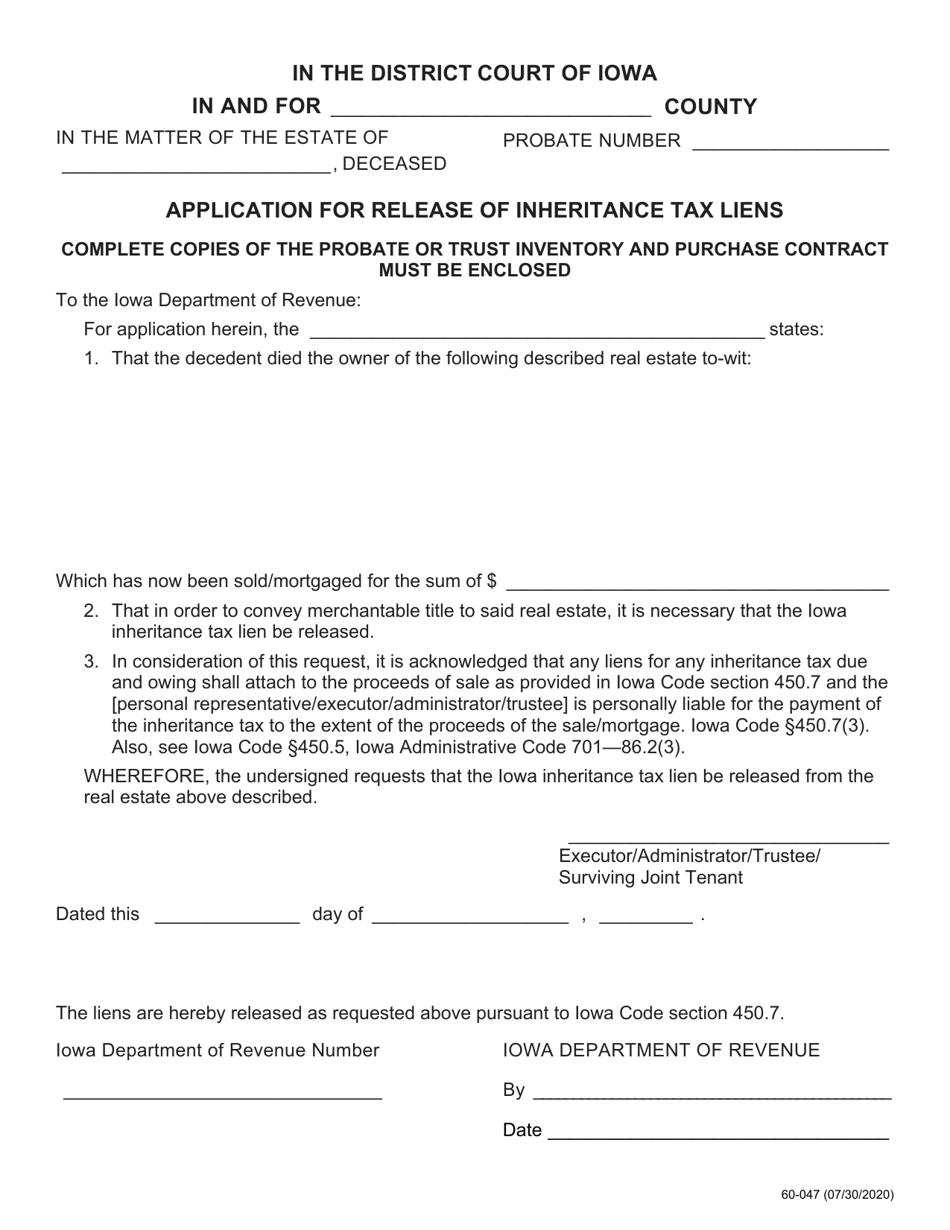

Form 60 047 Download Printable Pdf Or Fill Online Application For Release Of Inheritance Tax Liens Iowa Templateroller

Death And Taxes Nebraska S Inheritance Tax

Federal Gift Tax Vs California Inheritance Tax

Calculating Inheritance Tax Laws Com

Tax Talk Iowa S Inheritance Tax Gordon Fischer Law Firm

Inheritance And Estate Taxes Can Impact Ordinary Taxpayers Too

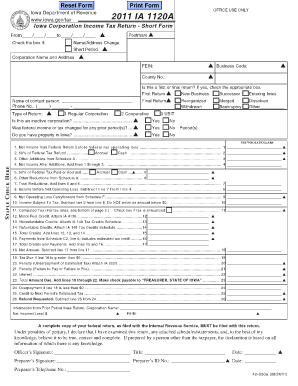

Iowa Short Form Fill Out And Sign Printable Pdf Template Signnow

States With Inheritance Tax Or Estate Tax Bookkeepers Com

Form Inheritance Tax Fill Out Sign Online Dochub

Nj It Nr 2010 2022 Fill Out Tax Template Online Us Legal Forms

:max_bytes(150000):strip_icc()/inheritance_tax-185234580-58bc7c225f9b58af5c8df46c.jpg)

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)